In the world of industrial processes, manufacturing, and various applications, efficiency is a key driver of success. Every organization strives to optimize their production, reduce costs, and enhance performance. One potent tool that has proven to be a game-changer in maximizing efficiency is Chemate Sodium Hexametaphosphate, commonly known as SHMP. In this blog post, we will explore the role of SHMP in boosting efficiency across diverse industries and applications.

Understanding Sodium Hexametaphosphate (SHMP)

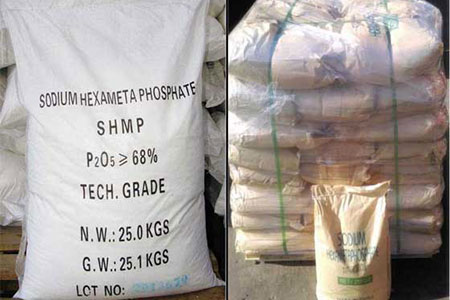

Sodium Hexametaphosphate (SHMP) is a versatile inorganic compound with the chemical formula (NaPO3)6. It is typically found in the form of a white powder or granules. Its unique molecular structure allows it to perform a wide range of functions, making it a go-to additive in various industrial processes.

Applications in Detergents and Cleaners

One of the primary applications of SHMP is in the manufacturing of detergents and cleaners. Its ability to sequester calcium and magnesium ions makes it an excellent water softener, preventing the formation of unwanted mineral deposits on surfaces and fabrics. By incorporating SHMP in detergent formulations, cleaning efficiency is significantly enhanced, leading to cleaner and brighter results.

Water Treatment and Industrial Processes

SHMP plays a vital role in water treatment and various industrial processes. It acts as a dispersant and anti-scaling agent, preventing the precipitation of metal ions and maintaining equipment efficiency. In water treatment plants, SHMP chemical helps to improve the efficiency of filtration systems and reduces the likelihood of scaling and fouling in pipelines and heat exchangers.

Food Industry Applications

The food industry also benefits from SHMP’s efficiency-enhancing properties. In processed foods, SHMP serves as a sequestrant, binding metal ions and preventing undesirable reactions that could compromise product quality and shelf life. Moreover, in meat and seafood processing, SHMP aids in retaining moisture, improving texture, and enhancing yield.

Binder and Flux in Ceramics and Refractory Manufacturing

The ceramics and refractory industries rely on SHMP as a vital component. In ceramics, SHMP acts as a binder, improving the green strength of molded components and enhancing the sintering process. This results in products with improved mechanical properties and reduced defects. Similarly, in refractory manufacturing, SHMP serves as a flux, lowering the melting point of raw materials, and facilitating the formation of dense and high-strength products.

Textile Processing and Dyeing

The textile industry utilizes SHMP to optimize dyeing processes. As a dispersant and leveling agent, SHMP aids in achieving uniform dye penetration, preventing uneven color distribution in fabrics. This ensures vibrant and consistent colors, reducing dye consumption and minimizing wastage.

Improving Paper Quality

SHMP plays a pivotal role in paper manufacturing, acting as a dispersant and a retention aid. By enhancing fiber dispersion, SHMP helps produce smoother and more uniform paper, reducing paper defects and enhancing print quality. Additionally, it improves filler retention, leading to better paper strength and reduced fiber loss during production.

Enhancing Personal Care Products

The cosmetic and personal care industry also benefits from SHMP’s versatility. In personal care products such as toothpaste and mouthwash, SHMP acts as a sequestering agent, preventing the precipitation of minerals and enhancing product stability. Additionally, in skin and hair care products, SHMP serves as a viscosity modifier, improving product texture and consistency.

Sodium Hexametaphosphate (SHMP) is an indispensable tool for maximizing efficiency in a wide array of applications. Its unique chemical properties make it an ideal choice for water treatment, cleaning, food processing, and manufacturing processes. By incorporating SHMP into various industries, organizations can optimize production, reduce costs, and improve overall performance.

As technology continues to advance, the demand for efficient processes becomes more crucial than ever. Embracing the potential of Sodium Hexametaphosphate empowers businesses to stay ahead of the competition and achieve remarkable results in a sustainable manner. With SHMP, efficiency knows no bounds. Would like to know more about sodium hexametaphosphate and other phosphates, click here(www.chematephosphates.com).